Kings County, NY

$699,999

Kings County, NY

$699,999

REAL ESTATE INCLUDED

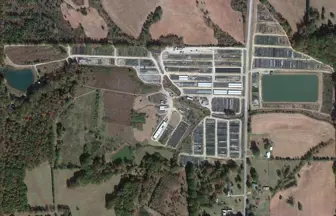

Mississippi

$450,000

REAL ESTATE INCLUDED

Texas

$7,602,818

Missoula, MT

$350,000

Rhode Island

$1,550,000

Hillsboro, OR

$3,500,000

REAL ESTATE INCLUDED

Roland, AR

$2,299,900

Honeydew, CA

$5,995,000

REAL ESTATE INCLUDED

Indiana

$2,700,000

Washington

$30,000

Minnesota

$1,525,000

Monmouth County, NJ

$130,000

Iowa

$395,000

$1,600,000

Norman, OK

Murphys, CA

$229,000

New York

Not Disclosed

Cash Flow: $392,000

Robert Allen

Robert Allen

Serving Warren County, KY

ExitWay specializes in connecting buyers and sellers of businesses, focusing on developing effective exit strategies and business transition plans. With expertise in business valuation, acquisition strategy, due diligence analysis, business brokerage, and commercial real estate, they help clients maximize the value of their assets. Serving primarily Kentucky and Tennessee, including cities such as Nashville, Bowling Green, and Owensboro, ExitWay offers deep local market knowledge to ensure successful transactions. Headquartered in Bowling Green, KY, the company also supports clients from outside these regions.

Thomasville, NC

$25,000

Maricao

$3,500,000

REAL ESTATE INCLUDED

Oklahoma

Not Disclosed

Cash Flow: $12,611

Honolulu, HI

$180,000

Los Angeles County, CA

$200,000

REAL ESTATE INCLUDED

Dickson, TN

$250,000

Not Disclosed

EBITDA: $398,262

New York County, NY

$215,000

$2,840,000

Guyton, GA

REAL ESTATE INCLUDED

$1,900,000

REAL ESTATE INCLUDED

Duncan, BC

$6,950,000

Fayetteville, AR

$225,000

Oakland County, MI

$149,900

Palm Beach County, FL

$275,000

Yavapai County, AZ

$189,000

British Columbia

$1,500,000

Cleveland, OH

$247,500

Riverhead, NY

$650,000

Omaha, NE

$145,000

$360,000

Alaska

Oregon

$13,900,000

Allegheny County, PA

$450,000

Festus, MO

$2,650,000

Montana

$7,000,000

REAL ESTATE INCLUDED

Union Springs, NY

$2,499,000

REAL ESTATE INCLUDED

Russia

$2,950,000

Seminole County, FL

$1,399,000

REAL ESTATE INCLUDED

Florida

$9,000,000

Jim Maxwell, JD/EA, CRE

Maxwell & Associates, PLLC

Serving Richmond City County, VA

Our Full-Service M&A Advisory Includes The Following Exclusive Sale Representation Understand client objectives and expectations and design a sale process to achieve such goals, including but not limited to, maximizing the value of the client’s business and included commercial real estate and closing the transaction on the best possible terms. Develop an appropriate buyers list and all of the related transaction marketing materials, which would typically include a comprehensive Confidential Memorandum. Manage the distribution of the business acquisition and any included commercial real estate on all major business sales and commercial real estate sales platforms. Manage all communications and interaction with prospective buyers, including marketing calls, follow up data requests, and site visits. Evaluate and negotiate offers from interested parties and work with the client to select the buyer and sign a Letter of Intent. Manage the post-LOI closing process including buyer due diligence and the negotiation and execution of the definitive transaction documentation. Buy-Side Advisory Identify and assess potential targets. Perform valuation and business analysis. Advise regarding transaction pricing and structure. Negotiate Letter of Intent. Manage closing process including performing due diligence on the target and negotiating the definitive transaction documentation. Assist in identifying and securing financing if required. Assist in lease negotiations and commercial real estate acquisition. Pre-Sale Consulting Thoroughly assess the operations and financial condition of a business from a potential buyers’ perspective. Make recommendations and assist as required to develop long-term strategies regarding: Business development and growth opportunities Capital structure optimization Financial systems and controls Management requirements Technology and IT systems Timing of a potential sale or recapitalization Business Valuations Tax planning Strategic business planning Brand Audit and marketing assessment Valuation of commercial real estate included in the transaction Post-Sale Consulting Thoroughly assess the operations and financial condition of a business from the perspective of the newly formed merged entity Make recommendations and assist as required to develop long-term strategies regarding: Business development and growth opportunities Brand Planning and marketing strategy for newly formed entity Financial systems and controls Management requirements Technology and IT systems Tax planning Strategic business planning for newly formed entity Commercial Real Estate Services Thoroughly assess and perform valuation for the commercial real estate included in the business transaction. Represent the seller or buyer on the commercial real estate included in the deal for sale or lease. Make recommendations and assist as required to develop strategies regarding: Sale leasebacks Landlord and tenant representation Lease transfers New site selection

North Carolina

$1,750,000

Colorado

$6,000,000

$950,000

Brownsburg, IN

$3,500,000

North Carolina

Not Disclosed

Cash Flow: $729,571

Maine

$200,000

REAL ESTATE INCLUDED

Lometa, TX

$1,587,500

Springfield, IL

$299,500

Santa Cruz County, CA

$1,100,000

REAL ESTATE INCLUDED

$2,950,000

Agriculture businesses offer a diverse range of operations for entrepreneurs and organizations to explore.

Crop-focused enterprises include farms and orchards, grain handling and storage businesses, hydroponic vegetable farms, and cannabis cultivation centers. These organizations specialize in the growing, processing, and storage of produce such as grains, vegetables, fruits, and cannabis.

Livestock and animal product-based businesses include commercial honey production, ranch lending, and mobile butchering services. These businesses revolve around farm animals and their byproducts, offering innovative solutions such as mobile meat processing or honey production.

Market Snapshot

If you’re in the market to buy or sell an agriculture business, it helps to have some context on how these businesses are valued, and some benchmarks on financial performance. To that end, we have aggregated data on financials and prices of agriculture businesses listed for sale.

|

Number of Business Listings Analyzed |

216 |

|

Median Asking Price |

$1,222,349 |

|

Median Reported Revenue |

$842,387 |

|

Median Reported Earnings |

$292,629 |

|

Financials based on businesses that listed an asking price, annual revenue, and seller's discretionary earnings. |

|

Agriculture Business Valuation Multiples

|

Range |

Revenue |

Earnings (SDE) |

|

Lower Quartile |

0.69 |

2.80 |

|

Median |

1.21 |

4.00 |

|

Upper Quartile |

2.21 |

5.91 |

|

Revenue and earnings multiples based on reported revenue, seller's discretionary earnings, and asking price. |

||

Read the Report for Insights into Sold Comp Data:

Agriculture Business Valuation Benchmarks

FAQs

How much does it cost to buy an agriculture business?

The median asking price for agriculture businesses listed for sale is $1,222,349.

How much does an agriculture business owner earn?

The median reported revenue for agriculture businesses listed is $842,387 while owners report median earnings of $292,629.

How do I value an agriculture business?

Valuing an agriculture business involves considering several factors, including annual sales, profit, inclusion of real estate, and trends in the local market. Brokers, business owners, and business buyers will typically rely on valuation multiples to gauge business value relative to similar businesses in the market. Revenue multiples among agriculture businesses listed for sale in range from 0.69 to 2.21, with the median at 1.21. Earnings multiples range from 2.80 to 5.91, with the median at 4.00. These values suggest a typical agriculture business may sell for around 1.2 times its annual revenue, and 4 times its annual owner’s earnings.

More for Business Buyers:

Set Up Alerts and Notifications

Business Buyer Learning Center

More for Business Sellers:

Learn How to Value and Sell a Business

Get Local Business Valuation Data

```