Dallas County, TX

$220,000

Dallas County, TX

$220,000

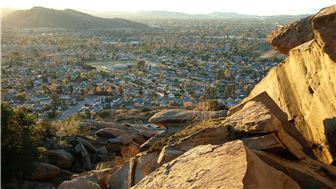

Simi Valley, CA

$625,000

Dickinson, ND

$350,000

Bristol County, MA

$650,000

Lake County, IL

$2,159,801

Pennsylvania

$515,000

San Antonio, TX

$15,000

Rensselaer County, NY

$175,000

Jackson County, OR

$300,000

Florida

$1,700,000

Maryland

$1,300,000

Maryland

$495,000

New Mexico

$970,000

$1,450,000

Montgomery County, MD

Arlington, TX

$312,500

Beach Haven, NJ

$200,000

Britt Clas

Earned Exits Business Brokers

Serving Denver County, CO

The national experts for selling companies with $1M-$40M in revenue in 17+ industries. The Earned Exits Team goes beyond just maximum value and brings you the most meaningful value. We know firsthand that selling your business for “maximum value” is much more than price. Together, we get to know you to discover what is most meaningful to you at deal closing and for your life beyond the business. In addition to sales price, our knowledge of: how to take care of employee, customer and vendor relationships; your role in the future of the business; fit with the buyer; your reputation and legacy; tax advantages; protecting your confidential information at the various stages of the sales process; deal points such a cash at closing; and speed of closing will lead to the most meaningful sale for you.

Bristol County, MA

$640,000

California

$800,000

Gaston County, NC

$535,000

Utah County, UT

$1,700,000

Minnesota

$250,000

Minnesota

$900,000

Maricopa County, AZ

$425,000

Suffolk County, NY

$350,000

San Luis Obispo County, CA

$1,675,000

Westchester County, NY

$1,100,000

Georgia

$800,000

Missouri

$170,000

Bristol County, MA

$600,000

West Virginia

$550,000

Peabody, MA

$315,000

Hartford County, CT

$85,000

Texas

$249,000

Layton, UT

$149,995

Georgia

$500,000

Spokane County, WA

$2,300,000

Texas

$2,500,000

Texas

Cash Flow: $336,409

Montgomery County, OH

$895,000

Ohio

$330,000

Colorado

Cash Flow: $457,000

Oakland County, MI

$437,109

Michigan

$810,591

Arkansas

$460,000

Tia Yeo

Skyline Properties, Inc.

Serving King County, WA

$1,195,000

Marin County, CA

$350,000

Pleasant Grove, UT

$170,000

Fort Mill, SC

$450,000

Austin, TX

$1,000,000

Montgomery County, OH

$569,784

Idaho

$350,000

Accounting and tax businesses listed for sale on BizBuySell encompass a range of services aimed at managing financial records, ensuring compliance with tax regulations, and providing strategic financial advice to optimize financial performance. These firms primarily engage in accounting services such as payroll, bookkeeping, and financial statement preparation, tax preparation and planning, and advisory services such as business consulting, financial analysis, and forecasting.

If you are in the market to buy or sell an accounting and tax firm, it’s important to understand how these businesses perform financially, and how they are valued in the business for sale market. To help you get started, we have aggregated data from accounting and tax business for sale listings to surface typical financials as well as revenue and earnings multiples based on asking prices. These values can provide relevant context when evaluating individual businesses.

Market Overview

|

Number of Businesses Analyzed |

567 |

|

Median Asking Price |

$434,500 |

|

Median Reported Revenue |

$406,946 |

|

Median Reported Earnings |

$197,650 |

|

Financials based on businesses that listed an asking price, annual revenue, and seller's discretionary earnings. |

|

Accounting & Tax Business Valuation Multiples

|

Range |

Revenue |

Earnings (SDE) |

|

Lower Quartile |

1.00 |

1.75 |

|

Median |

1.11 |

2.22 |

|

Upper Quartile |

1.21 |

2.81 |

|

Revenue and earnings multiples based on reported revenue, seller's discretionary earnings, and asking price. |

||

Read the Report:

Accounting & Tax Practice Business Valuation Benchmarks

FAQs

How much does it cost to buy an accounting and tax business?

Prices vary depending on the size of the business listed, but the median asking price for an accounting and tax practice is $434,500.

How much do accounting and tax business owners earn?

Accounting and tax practice owners report median annual sales of $406,946 and annual owner earnings of $197,650. These figures are based on businesses that have listed their annual revenue and seller's discretionary earnings.

How do I value an accounting practice?

Valuing an accounting and tax business involves considering several factors, including annual sales, profit, growth (or decline) trends, and demographic trends of the local market. Brokers, business owners, and business buyers will typically rely on valuation multiples to gauge business value relative to similar businesses in the market. Revenue multiples among accounting and tax practices listed for sale range from 1.00 to 1.21, with the median at 1.11. Earnings multiples range from 1.75 to 2.81, with the median at 2.22. These values suggest the average accounting and tax practice business in the U.S. may sell for around 1.11 times its annual revenue, and 2.22 times its annual owner’s earnings.

More for Business Buyers:

Set Up Alerts and Notifications

Business Buyer Learning Center

More for Business Sellers: